Health insurance quotes, made simple

Get a health insurance rate online in less than 5 minutes, no medical questions required.

*No credit card and no commitment required.

Recent health insurance quotes

Guaranteed Issue Classic:

23-year-old in Toronto, ON

Guaranteed Issue Economic:

70-year-old in Saskatoon, SK

Guaranteed Issue Advanced:

40-year-old in Victoria, BC

Health insurance quotes by province

Province | Monthly Premium |

|---|---|

Alberta | $118.29 |

British Columbia | $116.84 |

Manitoba | $105.37 |

New Brunswick | $111.61 |

Newfoundland and Labrador | $111.24 |

Nova Scotia | $101.24 |

Northwest Territories | $118.29 |

Nunavut | $105.37 |

Ontario | $134.05 |

Prince Edward Island | $108.79 |

Quebec | $123.32 |

Saskatchewan | $78.39 |

Yukon | $116.84 |

* Monthly premiums for Canadians aged 21-44 on PolicyMe’s Guaranteed Issue Economic Plan. Rates are effective April 1st, 2025 and are subject to change.

Health insurance quotes by age

Age | Monthly Premium |

|---|---|

0-4 | $34.18 |

5-20 | $49.04 |

21-44 | $78.39 |

45-54 | $91.25 |

55-59 | $106.38 |

60-64 | $117.48 |

65-69 | $105.00 |

70-74 | $106.92 |

75-79 | $122.09 |

80-100 | $132.67 |

* Monthly premiums for residents of Saskatchewan on PolicyMe’s Guaranteed Issue Economic Plan. Rates are effective April 1st, 2025 and are subject to change.

Health insurance quotes by plan type

Age | Economic | Classic | Advanced |

|---|---|---|---|

0-4 | $34.18 | $36.92 | $48.52 |

5-20 | $49.04 | $54.85 | $76.10 |

21-44 | $78.39 | $90.68 | $114.69 |

45-54 | $91.25 | $109.38 | $140.21 |

55-59 | $106.38 | $120.42 | $152.58 |

60-64 | $117.48 | $131.21 | $164.62 |

65-69 | $105.00 | $120.70 | $151.46 |

70-74 | $106.92 | $133.05 | $184.55 |

75-79 | $122.09 | $144.43 | $193.78 |

* Monthly premiums for residents of Saskatchewan on PolicyMe’s Guaranteed Issue Economic, Classic and Advanced Plans. Rates are effective April 1st, 2025 and are subject to change.

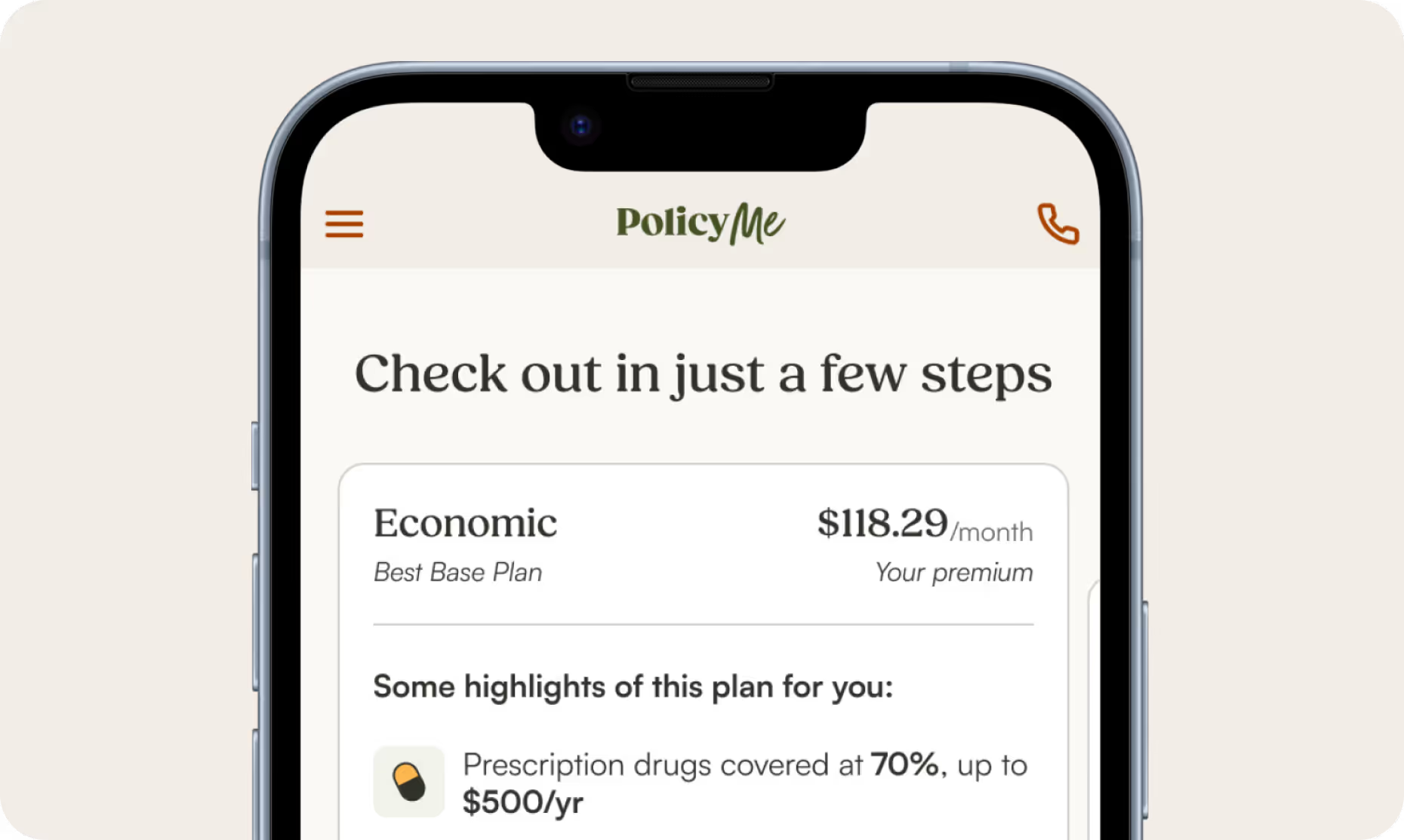

PolicyMe health insurance plans, at a glance

Prescription Drug Coverage:

70%, up to $500/yr

Dental Coverage:

$500 every year of your plan

Eyewear:

$200 every 2 years

Professional Services:

50% (max $600/yr in total)

Mental Health Services:

$500/yr

Other Extended Healthcare Benefits:

Included

Prescription Drug Coverage:

70%, up to $600/yr

Dental Coverage:

$750 in year 1, $900 every year after

Eyewear:

$250 every 2 years

Professional Services:

80% (max $750/yr in total)

Mental Health Services:

$800/yr

Other Extended Healthcare Benefits:

Included

Prescription Drug Coverage:

70%, up to $700/yr

Dental Coverage:

$800 in year 1, $1,200 every year after

Eyewear:

$400 every 2 years

Professional Services:

80% (max $1,000/yr in total)

Mental Health Services:

$1,300/yr

Other Extended Healthcare Benefits:

Included

What affects your health insurance quote in Canada

Three key factors impact the cost of personal health insurance in Canada:

Your age

Older Canadians pay higher premiums. The younger you are, the more money you’re saving for your insurance provider.

Where you live

Insurance companies look at average healthcare costs in your province or territory when estimating how much to charge for a policy.

The plan you select

The more coverage on your health insurance plan, the more you’ll pay in premiums.

Private health coverage is cheapest for Canadian residents under age 21, with the steepest costs starting in your mid-50s. It’s also cheapest in Saskatchewan, Manitoba, and Prince Edward Island and most expensive in Ontario and Quebec.

How to save on your health insurance quote

1. Review your current health costs

Write down what you already pay out of pocket for healthcare that isn’t covered by your provincial plan. Include things like dental visits, prescriptions, eyeglasses, and physiotherapy.

2. Estimate upcoming expenses

Think about any big healthcare costs you expect in the next year. For example, major dental work or buying new glasses.

3. Add up your yearly total

Combine your current and expected costs to get a sense of how much you actually spend each year on healthcare.

4. Compare costs with insurance premiums

Look for private health insurance plans with premiums that are lower than or close to what you currently spend. If you spend more than $1,000 a year on uncovered care, a more complete plan could save you money.

5. Choose coverage that fits your needs

Focus on getting a plan that matches your actual healthcare habits. Avoid paying for coverage you’re unlikely to use.

6. Ask for help if you’re unsure

You can run these numbers yourself or talk to a licensed insurance advisor. They can help you find the right plan for your situation.

Why choose PolicyMe for a quote

PolicyMe offers some of Canada’s most affordable private health insurance plans with a quick, easy online application process and transparent customer support. In addition to health insurance, PolicyMe provides $10B+ of protection for Canadians through life insurance and critical illness insurance products.

- Every $100 of coverage costs an average of $0.42 per month

- $10,000 of accidental dental coverage included in all plans

- Unlimited ambulance coverage (land or air)

- Guaranteed Issue plans don’t require a medical exam or questionnaire

- Plans backed by Securian Canada, a leader in the Canadian insurance industry

- A+ Better Business Bureau rating

- 4.9 star average rating from Google users

How PolicyMe’s health insurance works

We’ve made the process of getting covered super simple. There’s no need to dig up old records or paperwork. In case you need it, we have expert advisors ready to help!

Tell us about yourself

Get a personalized plan recommendation and quote.

Select your plan

Choose a plan tailored to your needs.

Choose a start date

Select the next business date or any date 90 days from now to activate your coverage.

Reviews matter. And we've got hundreds of them

Not interested in our glowing reviews? Read the 1 and 2-star reviews that we’ve worked to make better. (See, we told you we were honest.)

Need help with health insurance quotes? Speak with an advisor

Schedule your appointment or call us anytime Monday to Friday at +1 (866) 999-7457

- Needs Analysis: get help choosing the right plan

- Benefits Breakdown: understand how to maximize your coverage

- Q&A: learn everything you need to know about your policy

FAQ: Health insurance quotes in Canada

In Canada, personal health insurance is a supplementary product that Canadians can purchase to cover the cost of medical services that government-sponsored public health insurance won’t cover. Common medical expenses that you may need private health insurance to cover partially or completely include dental care and orthodontics, prescription drug coverage, mental health services, vision care, and visits to paramedical professionals like physiotherapists. If you don’t have access to a group plan through your workplace, individual personal health insurance can help to close key coverage gaps.

Many Canadian health insurance quotes include dental coverage in the cost of your plan — but not all. For instance, PolicyMe’s Economic and Classic plans include some coverage for basic dental care like routine cleanings, but may not cover orthodontics or certain types of major services like crowns and bridges. The Advanced plan, on the other hand, includes coverage for all of these dental services with higher reimbursement levels. You can also purchase a standalone dental insurance plan through PolicyMe. Before getting health insurance quotes, be sure to ask about any dental coverage included in your quote.

To get a health insurance quote from PolicyMe, simply fill out the quick questionnaire with your basic details like age and province. We'll instantly provide a personalized plan and recommendation quote for you.

If you have any questions or need assistance, our licensed advisors are just a click or call away. We’re here to ensure you get the right coverage, all with a process that’s simple, transparent, and affordable. Get started now and secure your health and peace of mind with PolicyMe.

Health insurance quotes in Canada are based primarily on factors like your age, where you live, and the specific insurance plan you select. Plans with higher levels of coverage, applicants in provinces like Ontario with higher healthcare costs, and older applicants can all lead to higher health insurance costs.

Comparing health insurance quotes in Canada might seem like a headache, but it doesn’t have to be. Start by listing your must-haves: prescription drugs, dental care, vision, and any other specific needs. Once you have your list, hop online to get quotes from different providers. Use comparison tools to see the differences side by side. Don’t just look at the price—consider what’s included in the coverage. Are prescription drugs, dental visits, and vision care part of the deal? How about extra perks like telehealth services or extended health benefits?

Next, dig a bit deeper into the fine print. Check for waiting periods, exclusions, and claim processing times. Some policies might look cheap but come with longer waiting periods or fewer covered services. Also, see if the provider has a good reputation for customer service—nobody wants to be stuck on hold forever when you have a claim to process. And remember, if you have questions or need help, most providers have licensed advisors ready to assist you. Comparing quotes thoroughly ensures you get the best bang for your buck and the coverage that fits your needs.

Have a question we didn’t answer?

Call +1 (866) 999-7457 from 9AM-5PM EST Monday to Friday or email us. Our insurance expert team is happy to help!